From Chaos to Automated Financial Reporting & Consolidation in ONE MONTH!

- Sanita Viba

- Mar 26, 2025

- 11 min read

Updated: Dec 18, 2025

Is It Really Possible? Yes!

Automating financial reporting and consolidation across all Group companies in just ONE month? Sounds ambitious, right? But with the right approach, a dedicated team, and a powerful reporting system, it’s entirely possible.

💡If you're from a Venture Capital and Private Equity Fund aiming to implement automated reporting across Portfolio companies without needing consolidated results, skip Step 8 on consolidation setup - and enjoy unified, automated reporting across your entire portfolio!

Many businesses hesitate to start financial reporting automation due to concerns about data inconsistencies among Group companies or outdated accounting systems. However, the reality is: you don’t need perfect data to start. You can begin automation with your existing accounting systems and financial data as they are, even if they are not flawless.

In this article, we’ll cover:

How to implement automated reporting & consolidation in one month

What resources & team roles are needed

The step-by-step process to get it done—fast!

Table of Contents:

1) Financial Data Chaos - The Main Challenge to Automated Reporting

When the goal is to automate financial reporting and consolidation to get a BIG picture of your Group’s financial performance, there are always challenges with data quality:

❌ Outdated accounting or ERP systems

❌ Different accounting or ERP systems across Group entities

❌ Inconsistent Local Chart of Accounts (COA)

❌ Concerns about the overall quality of accounting data

A common mistake? Trying to solve every issue before starting automation. This delays achieving the BIG picture and transparency of the entire Group's financial performance, and makes reporting even more complex.

The solution? Start implementing a reporting system that:

Handles data quality validation

Works with your current accounting & ERP systems

Imports available financial data - even if not perfect

Provides a unified reporting & consolidation view for the entire Group with drill-downs to the transaction level.

💡 Once your automated reporting system is in place, you can refine and improve data quality over time, while still having full financial transparency!

2) Choosing the Right Reporting and Consolidation Software & Team Setup

To implement automated reporting & consolidation in one month, you need the right team & tools:

Project Leader - The Key Person Driving the Implementation: A dedicated finance professional from the Group Finance Team should allocate around 80% of their time to the project. This person should be skilled to: ▪ Handle the Group Chart of Accounts (COA), dimension structure, reporting requirements, and consolidation complexity. ▪ Be comfortable communicating with Local finance teams. ▪ Be able to coordinate data collection, mapping, and import.

Group CFO - Providing Strategic Direction: Even if not a Project leader, the Group CFO should be partly involved, especially to: ▪ Approve the Group COA and dimension structure. ▪ Endorse decisions on data import tactics and currency translation strategies, and ensure that other key decisions are aligned with business objectives.

Advanced Reporting & Consolidation System - The Core of Automation: The system should: ▪ Support data imports from current accounting and ERP systems you have in the Group (even with different local COAs). ▪ Validate financial data at every import to ensure reporting accuracy and reliability. ▪ Ensure automated reporting and consolidation in a unified format with detailed drill-downs to the transaction level. ▪ Perform automated currency translation, intra-group elimination & consolidation adjustments at the transaction level.

Choose a system that is: ▪ Ready for setup & immediate use. ▪ Does not require any additional development. ▪ Can be used regardless of your global location.

Local Finance Teams - Providing Accounting Data: Local finance teams should allocate minimal time during implementation. Their main role is to: ▪ Extract sample Trial Balance and Transaction (GL) reports from their accounting or ERP systems. ▪ Help the Project Leader map local accounts to the Group COA (if needed).

IT Support – Optional for Automation: If full automated integration with accounting or ERP systems is planned, IT support may be required. However, many modern reporting systems allow: ▪ Manual Excel-based imports, meaning no IT support is needed initially. ▪ Flexible automation options, allowing IT involvement only when required.

3) When is the Best Time to Start Automating Financial Reporting? RIGHT NOW!

There’s no perfect time to start automating financial reporting - the best time is today! Whether it’s the start, middle, or end of the year, allocate just ONE month to implementation!

Implementing automation now means: ▪ You get validated and reliable current and historical data of all Group entities in a unified format without waiting for ERP upgrades. ▪ You can access financial insights immediately, even at the transaction level, while improving data over time. ▪ You can compile any report you need and enjoy the convenience of consolidated data. ▪ You’ll save significant time for financial teams by eliminating manual reporting.

4) How to Automate Financial Reporting & Consolidation in One Month (Step-by-Step)

Let's start from the point where you've selected the reporting system, deployed it on the server, and are ready for setup. A project leader is geared up to take charge, and you've secured the buy-in from all key stakeholders.

💡 We will use screenshots from Emfino Demo system. The Demo system is an extensive knowledge database available to Emfino | Financial Reporting, Consolidation, and Budgeting system clients.

4️⃣.1️⃣. Build a Unified Group Chart of Accounts (Group COA)

The Group Chart of Accounts (COA) is the foundation of your reporting system. It ensures data consistency across all legal entities. The Group COA has to be imported into the reporting system.

💡 For detailed guidelines on creating an effective Group COA, refer to our previous article: 'Designing a Powerful Group Chart of Accounts (Group COA) for Effective Automated Consolidation'.

4️⃣.2️⃣. Define a Group Dimension Structure

The significance of the Group Dimension structure parallels that of the Group COA. Initially, lay out the logic and primary usage of dimensions in your Group reporting. You can refine and expand on the details as you progress.

4️⃣.3️⃣. Review and Verify Data Import Formats

This step can be performed in parallel with the first two. Each reporting system has specific data import requirements that must be met to ensure that data can be imported into the system.

For example, for Emfino the minimum required data imports include:

Transactions (GL) Report: The most detailed report from the accounting or ERP system, capturing all transactions for the selected period. The required fields (data columns) in the Transaction report are: transaction date, partner name, account number, debit and credit amounts in local currency.

Monthly Trial Balance Report: A report that summarizes opening balances, turnover, and closing balances per account. The required data columns are: opening balances, turnover debit, turnover credit, and closing balances.

Sample Transactions and Trial Balance reports from accounting or ERP systems are uploaded into Emfino, typically in Excel format. The Emfino team verifies the formats and configures the system to recognize them. Once set up, the system is ready for data uploads.

💡 For more information regarding Emfino data imports and requirements, see 'Data Import Types'.

4️⃣.4️⃣. Prepare Mapping and Advanced Mapping for Clean, Accurate Data

If each legal entity uses a different Local COA or dimension structure, these must be mapped to the Group COA and Group dimensions.

If data from Local entities appears less than perfect or lacks detailed elements (e.g., partner names are missing in intra-group transactions, or transactions are booked in the incorrect account), advanced mapping can be used to improve data quality until the implementation of Group COA requirements in all Group entities.

💡 Advanced mapping ensures that even if local accounting data is inconsistent, the system can standardize it for accurate reporting. For examples of Advanced Mapping rules in the reporting system, see the post 'Advanced Mapping - Emfino Super Feature #10'.

4️⃣.5️⃣. Configure Currency Translation Strategies

Advanced reporting systems usually offer various automated currency translation strategies for instant local-to-reporting currency conversion, consistently applied across all Group entities. Consequently, the next step involves configuring these currency strategies for every account in your Group COA and inputting historical exchange rates if required.

A multi-currency reporting system should have automated integration with a trusted source of real-time and historical currency exchange rates to automate currency conversion across all entities at the transaction level. Currency conversion at the transaction level ensures you can see drill-downs to the transaction level for any numbers in consolidated reports.

.

💡 Once these strategies are set, all financial data is automatically converted into the Group's reporting currency. Refer to our blog post: 'Emfino Super Feature #3 - Foreign Currency Translation' .

4️⃣.6️⃣. Configure Data Validation and Import Checks

Many systems often miss this critical feature. Automated, built-in data validation checks guarantee the quality of data right from the first import. Advanced reporting systems should detect errors, inconsistencies, missing data, and even silent adjustments to historical accounting records.

At the implementation stage, only minimal configuration is usually required for these validation checks to function effectively. Check whether the reporting system you are considering ensures validation!

💡 Automated validation ensures that once data are imported, they are reliable and reflect the actual data in the accounting or ERP systems. Refer to our blog post: 'Emfino Super Feature #2 - Data Validation and Import Checks'.

4️⃣.7️⃣. Import and Review Financial Data in Built-in Financial Reports

Now, you’re ready to start importing historical and current financial data! Once the data are uploaded and if they pass system data validation checks, these data become instantly accessible in the system. You can analyze the entities' data using predefined reports.

To enhance the data quality obtained, refine the advanced mapping rules or adjust the currency translation settings.

💡 If a reporting system allows manual Excel imports first, you can start without waiting for full system integration.

To view the Balance Sheet split by Partners and/or dimensions, prepare and import a one-time file detailing the BS split of accounts by Partners and/or dimensions for the 1st month's TB opening balances. The system calculates the balance sheet splits in subsequent months.

4️⃣.8️⃣. Set Up Consolidation & Intra-Group Eliminations

Now comes the exciting part—setting up automated consolidation! After configuring consolidation, you should be able to view consolidated results in ANY of the reports with drill-downs to the transaction level😊(of course, if your chosen reporting system allows it).

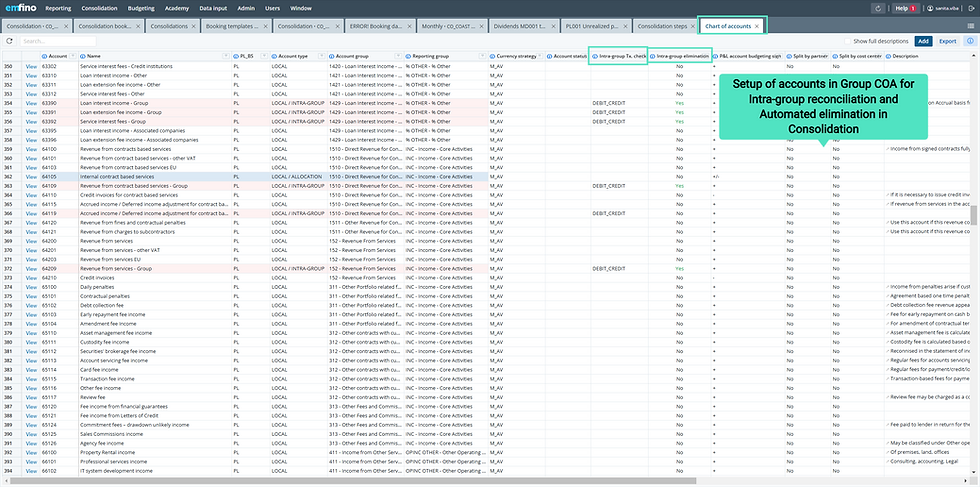

For example, in Emfino, the consolidation setup is as follows:

Define consolidation groups, specify which legal entities belong to each one, and the dates from - to.

Configure automated reconciliations and eliminations for intra-group transactions and balances in the Group COA.

Define rules for consolidation adjustment bookings. These bookings can be automated; for example, to eliminate an unrealized profit from the sale of a fixed asset to another Group company, you can set a formula-based rule for automated monthly consolidation adjustment booking, removing the unrealized profit from fixed assets, accumulated depreciation, and depreciation in the P&L.

💡 Once this setup is complete, your system will consolidate results automatically, eliminating the need for manual consolidation work! Refer to the blog post: 'Emfino Super Feature #1 - Advanced Automated Consolidation'.

4️⃣.9️⃣. Build Custom Reports, KPIs for Detailed Analytics

Now that financial data is flowing smoothly, it’s time to define custom reports to analyze Group financials, cost allocation, and profitability. Use comment fields to provide context for variances.

In Emfino, all available reporting templates and custom-built reports can be viewed with consolidated or aggregated data and drill-down views for transaction-level transparency.

💡 A powerful reporting system will let you generate any report instantly, with the ability to drill down into transactions for full visibility.

4️⃣.🔟. Integrate IFRS, GAAP & Group Adjustments

The automated reporting process becomes more efficient if IFRS, GAAP, and Group adjustments are booked directly into the reporting system for all relevant legal entities. Furthermore, the capability to automate these bookings in the system through predefined rules and formulas offers a substantial advantage. Once the adjustment bookings are defined, all reports allow the selection of IFRS, GAAP, or Group reporting type in addition to Statutory.

💡 Automating adjustments removes manual errors and ensures compliance with different financial reporting standards.

4️⃣.1️⃣1️⃣. Add Users & Set Up Flexible Access Rights

This is a very delightful step. It's finally time to introduce additional users to the automated Group reporting and consolidation! The reporting system provides tailored access permissions for data administration, viewing, budgeting, and variance commenting based on legal entities, system modules, reports, Group Chart of accounts ( Group COA), and dimensional structures, ensuring a secure and efficient data management environment.

💡 With the right user roles in place, everyone in the organization can benefit from automated reporting while maintaining security and control. Refer to the blog post: 'Flexible User Management - Emfino Super Feature #8'

5) Next Steps: Expanding Usage of the Reporting System

Once automated reporting and consolidation are live and you have a Big-Picture view of the Group's performance, you can focus on enhancing data quality across all legal entities.

💡Further improvements in data quality can be achieved by implementing group accounting and reporting requirements across all legal entities. Discover how to implement Group requirements in the article: 'Successful Implementation of a New Group Chart of Accounts (Group COA) Across the Group'.

Expand Usage of the Reporting System:

With increasing data quality requirements, expand further the usage and benefits of the reporting system:

Define Custom Data Validation Checks: Delight your financial controllers by allowing them to concentrate on data analysis while the system takes care of catching errors in imported data. Custom checks tailored to each entity can be defined as the focus shifts to enhancing data quality.

Incorporate New Data and Import Sources: Initiate imports of other vital data necessary for reporting and KPIs beyond accounting data.

Implement Cost Allocation: Move towards accurate profitability analysis by deploying automated and rules-based cost allocation.

Start Budgeting & Commenting Variances: Budgeting within the reporting systems aligns with actuals and automated reporting, while the flexibility of custom user permissions guarantees a secure and customized budgeting experience for every team member.

Enhance ERP system Integrations: Configure automated data imports for real-time updates.

💡 You don’t need to replace your ERP/accounting systems!

6) Ready to Automate Your Financial Reporting Process?

We encourage you to 👉 Book a Free Discovery Call — at a time that works best for you — to discuss your company's reporting, consolidation, and budgeting needs, showcase Emfino features in the Demo system, and help you understand whether Emfino is the right solution to simplify and automate your financial processes.

And

If you're curious about costs, you can also check our 👉 Pricing page! Unlike most middle-market reporting & consolidation tools that don't disclose pricing, we publish ours openly — transparent, predictable, with no hidden fees and no implementation fee. Transparency matters to us a lot.

In just ONE month, your company can move from manual chaos to automated financial reporting. Are you ready? 😊